bringing fake bags into uk | carrying a counterfeit bag bringing fake bags into uk Bringing in goods for personal use when you travel to the UK from abroad - types . CHANCE EAU VIVE is a floral-zesty fragrance with a fresh and invigorating jasmine heart. Unpredictable and in constant motion, the CHANCE EAU VIVE trail can be prolonged with the HAIR MIST. 2 products

0 · is carrying a bag illegal

1 · importing illegal goods into uk

2 · carrying a counterfeit bag

3 · carrying a bag without buying

4 · carrying a bag legally

5 · can you bring illegal goods into uk

6 · can i bring goods into uk

7 · bringing goods into uk from abroad

The Adam Project Speedy Watch. https://www.hodinkee.com/articles/ryan-reynolds-travels-through-time-with-an-omega-speedmaster-in-the-adam-project. Omega's Speedmaster Moon watch is a huge plot point of the movie. Loved to see another Omega featured in a movie. Did .

You’ll need to apply for a permit or certificate if you’re bringing items protected by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) into the.Bringing in goods for personal use when you travel to the UK from abroad - types .

UK customs information: Northern Ireland (accessible version) added. 31 .Check if your import, export or re-export needs a permit or certificate under the .Bringing in goods for personal use when you travel to the UK from abroad - types of tax and duty, duty free, EU and non-EU arrivals, banned and restricted goods.

This guide provides a brief summary of the procedure in place for the detention of counterfeit goods at UK borders and how IP rights holders can make the most of this service. . I recently travelled with a friend to Paris. I was bringing a beautifully-crafted non-designer handbag and she was carrying a Mirror Image Chanel Jumbo Flap in black caviar .It's not illegal to bring in counterfeit goods into the UK for personal use. It's possible border force could confiscate goods, but it's unlikely. However, importing counterfeit goods for commercial .

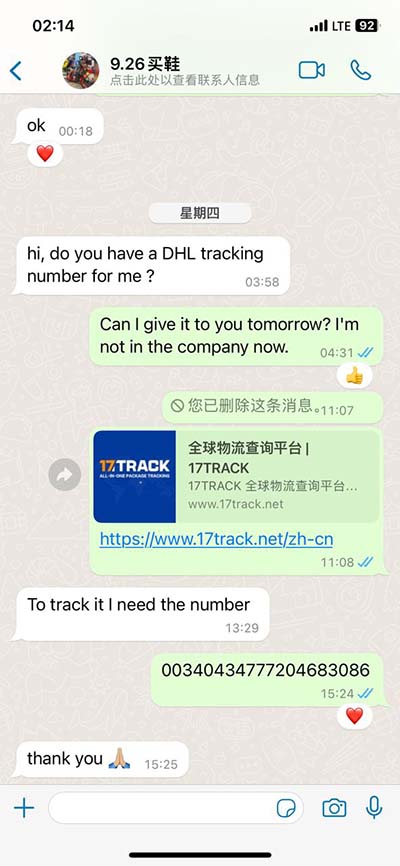

Border Force officers have stopped millions of pounds worth of fake goods from entering the UK in the run-up to Christmas. On a bright morning, customs officials are examining huge pallets of goods – offloaded from flights from Hong Kong and Pakistan – which are X-rayed on a conveyor belt, . If you are bringing £10,000 or more (or equivalent) in cash into the UK, you will need to make a customs declaration online at gov.uk/bringing-cash-into-uk. Amounts less than £10,000 (or equivalent) do not need to be declared.

If you are carrying commercial goods which are below the £1,500 threshold which are not restricted or excise goods or weigh not more than 1,000kg, you can make an online .

is carrying a bag illegal

For the most part the laws are there to stop people shipping bulk fake goods for sale in the UK. A couple of fake brand clothes items shouldn't draw any attention.You’ll need to apply for a permit or certificate if you’re bringing items protected by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) into the.Bringing in goods for personal use when you travel to the UK from abroad - types of tax and duty, duty free, EU and non-EU arrivals, banned and restricted goods. This guide provides a brief summary of the procedure in place for the detention of counterfeit goods at UK borders and how IP rights holders can make the most of this service. This guide was last updated in January 2018.

I recently travelled with a friend to Paris. I was bringing a beautifully-crafted non-designer handbag and she was carrying a Mirror Image Chanel Jumbo Flap in black caviar leather. I, and my friend, know very well that she was carrying a fake bag. It's not illegal to bring in counterfeit goods into the UK for personal use. It's possible border force could confiscate goods, but it's unlikely. However, importing counterfeit goods for commercial purposes is a criminal offence.

Border Force officers have stopped millions of pounds worth of fake goods from entering the UK in the run-up to Christmas.

On a bright morning, customs officials are examining huge pallets of goods – offloaded from flights from Hong Kong and Pakistan – which are X-rayed on a conveyor belt, while a sniffer dog. If you are bringing £10,000 or more (or equivalent) in cash into the UK, you will need to make a customs declaration online at gov.uk/bringing-cash-into-uk. Amounts less than £10,000 (or equivalent) do not need to be declared.If you are carrying commercial goods which are below the £1,500 threshold which are not restricted or excise goods or weigh not more than 1,000kg, you can make an online declaration within 5 days. For the most part the laws are there to stop people shipping bulk fake goods for sale in the UK. A couple of fake brand clothes items shouldn't draw any attention.

You’ll need to apply for a permit or certificate if you’re bringing items protected by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) into the.Bringing in goods for personal use when you travel to the UK from abroad - types of tax and duty, duty free, EU and non-EU arrivals, banned and restricted goods. This guide provides a brief summary of the procedure in place for the detention of counterfeit goods at UK borders and how IP rights holders can make the most of this service. This guide was last updated in January 2018. I recently travelled with a friend to Paris. I was bringing a beautifully-crafted non-designer handbag and she was carrying a Mirror Image Chanel Jumbo Flap in black caviar leather. I, and my friend, know very well that she was carrying a fake bag.

It's not illegal to bring in counterfeit goods into the UK for personal use. It's possible border force could confiscate goods, but it's unlikely. However, importing counterfeit goods for commercial purposes is a criminal offence. Border Force officers have stopped millions of pounds worth of fake goods from entering the UK in the run-up to Christmas.

On a bright morning, customs officials are examining huge pallets of goods – offloaded from flights from Hong Kong and Pakistan – which are X-rayed on a conveyor belt, while a sniffer dog. If you are bringing £10,000 or more (or equivalent) in cash into the UK, you will need to make a customs declaration online at gov.uk/bringing-cash-into-uk. Amounts less than £10,000 (or equivalent) do not need to be declared.If you are carrying commercial goods which are below the £1,500 threshold which are not restricted or excise goods or weigh not more than 1,000kg, you can make an online declaration within 5 days.

importing illegal goods into uk

The average pay for an Accountant is €40,702 a year and €20 an hour in Malta. The average salary range for an Accountant is between €28,614 and €49,413. On average, a Bachelor's Degree is the highest level of education for an Accountant.

bringing fake bags into uk|carrying a counterfeit bag